"Wealth in Numbers: The Ultimate Dealmaker’s Guide to SPVs, Syndication, and Private Investment" by Max Avery and Jake Claver demystifies Special Purpose Vehicles (SPVs) for both novice and experienced investors. This isn't your average finance book; it's a practical masterclass on leveraging SPVs to maximize returns in private investment deals. Learn how to build, manage, and utilize SPVs for capital raising, navigating regulations like 506(b) and 506(c), and ultimately achieving your investment goals. From deal initiation to profit distribution, this book provides a step-by-step blueprint for navigating the world of private investing, unlocking wealth-creation strategies previously accessible only to the elite. Prepare to elevate your portfolio and gain a competitive edge in today's market.

Review Wealth in Numbers

Wow, what a ride! "Wealth in Numbers" completely exceeded my expectations. As someone who's spent over three decades in financial services, I've seen countless investment books—many promising the moon, but delivering only stardust. This one is different. Avery and Claver have achieved something truly remarkable: they've made a complex subject, Special Purpose Vehicles (SPVs), not only understandable but genuinely engaging.

The book doesn't shy away from the intricacies of SPVs, syndicates, and private investment, but it presents this information with a clarity and accessibility that's truly refreshing. It's not just a theoretical discussion; it’s packed with practical, real-world examples that bring the concepts to life. I particularly appreciated the step-by-step guidance on building, managing, and leveraging deal flow using SPVs – something many books gloss over or treat as an afterthought. The authors clearly lay out the entire process, from initial deal initiation to navigating the regulations surrounding capital raising (like Regulation D 506(b) and 506(c)), leaving no stone unturned.

What sets "Wealth in Numbers" apart is its ability to cater to both beginners and seasoned investors. Whether you're just starting your investment journey or you're a seasoned pro looking to refine your strategies, you'll find valuable insights within these pages. The authors expertly balance detailed explanations with a friendly, approachable tone that keeps the reader engaged and motivated. There's no condescending language or overwhelming jargon; it feels like a conversation with experienced mentors who genuinely want to share their knowledge.

The numerous testimonials from successful investors and professionals speak volumes. These aren't just generic endorsements; they express genuine appreciation for the book's impact and the transformative potential of understanding SPVs. Reading their comments further solidified my belief that this book is a game-changer, especially in today’s fast-evolving financial markets. The book demystifies a strategy once accessible only to the elite, making it a powerful tool for anyone looking to build and secure their financial future.

Beyond the technical aspects, I was impressed by the authors' evident passion and commitment to helping readers succeed. Their enthusiasm is contagious, and it's clear that they've poured their hearts and considerable expertise into creating this comprehensive guide. It's more than just a book; it's a blueprint for creating wealth with purpose, a roadmap for navigating the sometimes-daunting world of private investment. "Wealth in Numbers" is a must-have for anyone serious about taking control of their financial destiny. I wholeheartedly recommend it, and I’m already looking forward to any future projects from Avery and Claver. Bravo, gentlemen! You've set a new standard for investment literature.

Information

- Dimensions: 6 x 1.09 x 9 inches

- Language: English

- Print length: 481

- Publication date: 2024

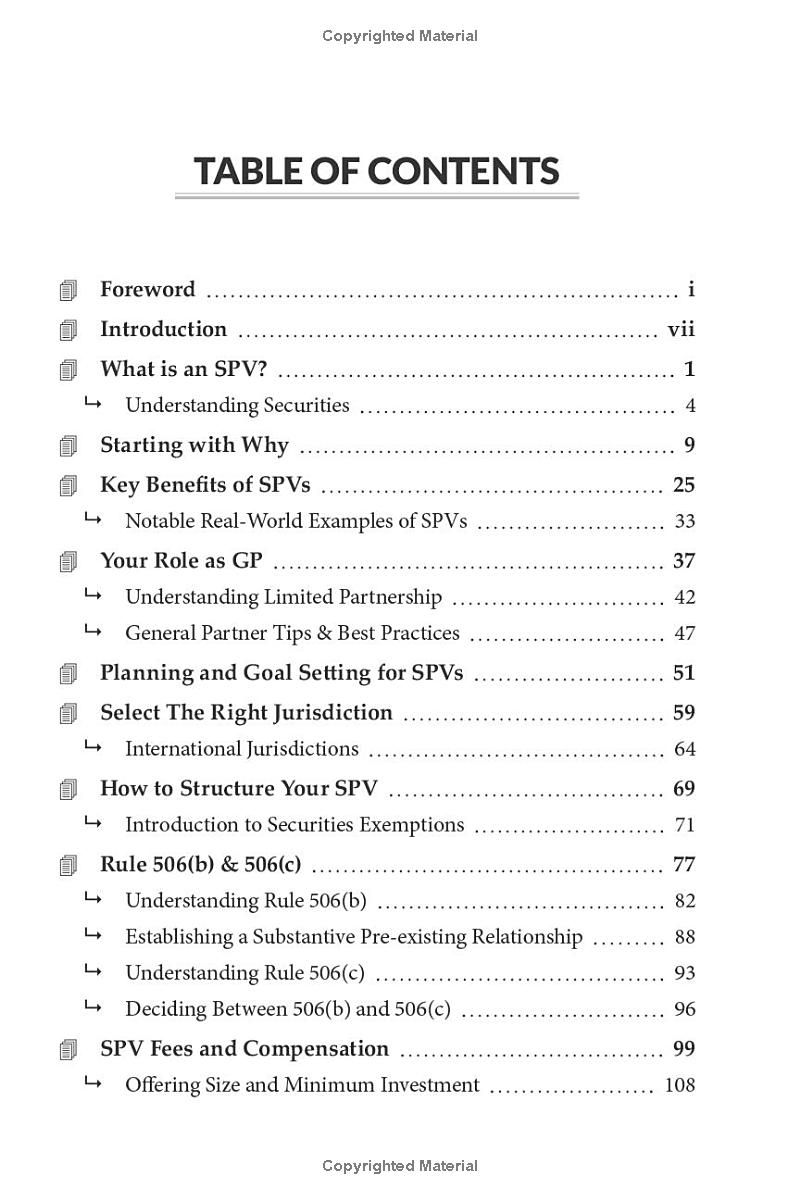

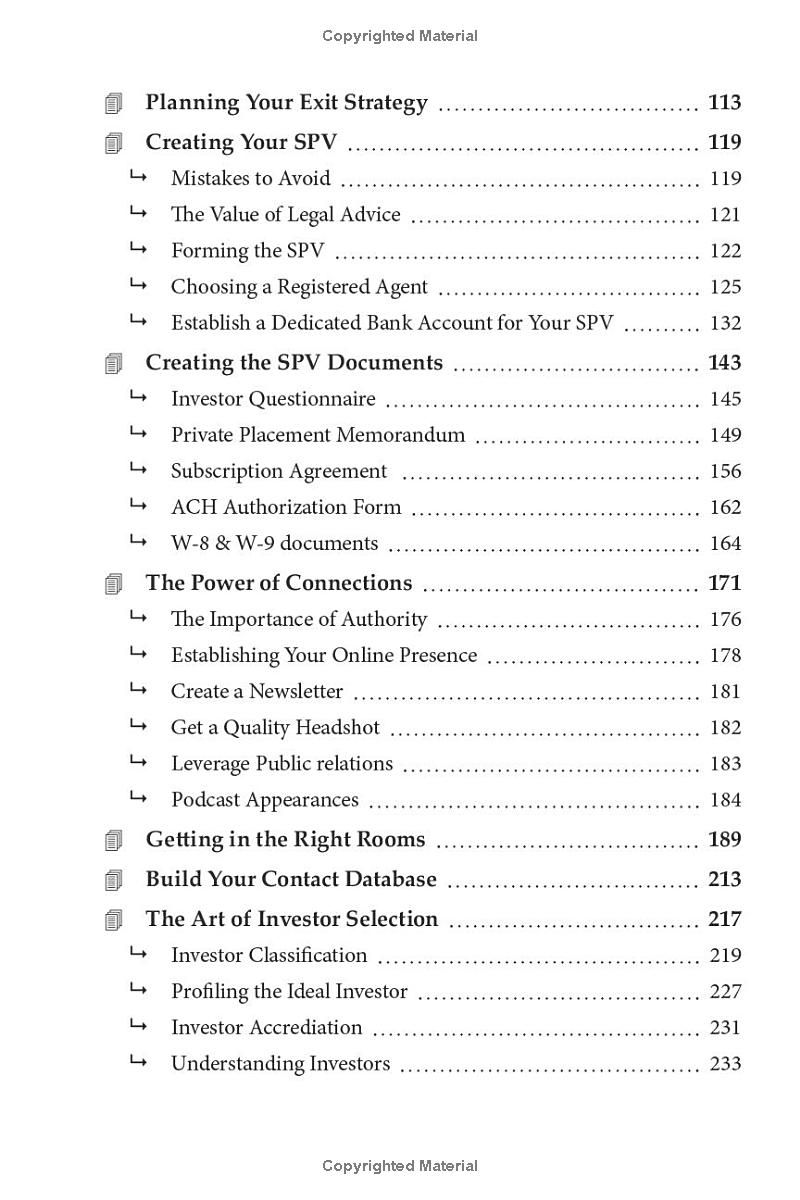

Book table of contents

- Foreword

- Introduction

- What is an SPV?

- Understanding Securities

- Starting with Why

- Benefits of SPVs

- Notable Real-World Examples of SPVs

- Your Role as GP

- Understanding Limited Partnership

- General Partner & Best Practices

- Planning and Goal for SPVs

- Select The Right Jurisdiction

- International Jurisdictions

- How to Structure Your SPV

- Introduction to Securities Exemptions

Preview Book